Demystifying Fusion Technology: From Science to Business with Sir Ian Chapman

In our recent podcast series, The Fusion Frontier: Investing in Tomorrow’s Energy, we spoke to experts in fusion energy and investment to dig deeper into the potential of fusion as a clean energy source, why investors invest in fusion, and some of the risks and opportunities along the way.

In Episode 2, we spoke to Sir Ian Chapman, CEO of the UK Atomic Energy Authority, to bridge the gap between science and business.

Here are 3 key insights from the conversation.

1. The best solution for fusion won’t necessarily be the first one

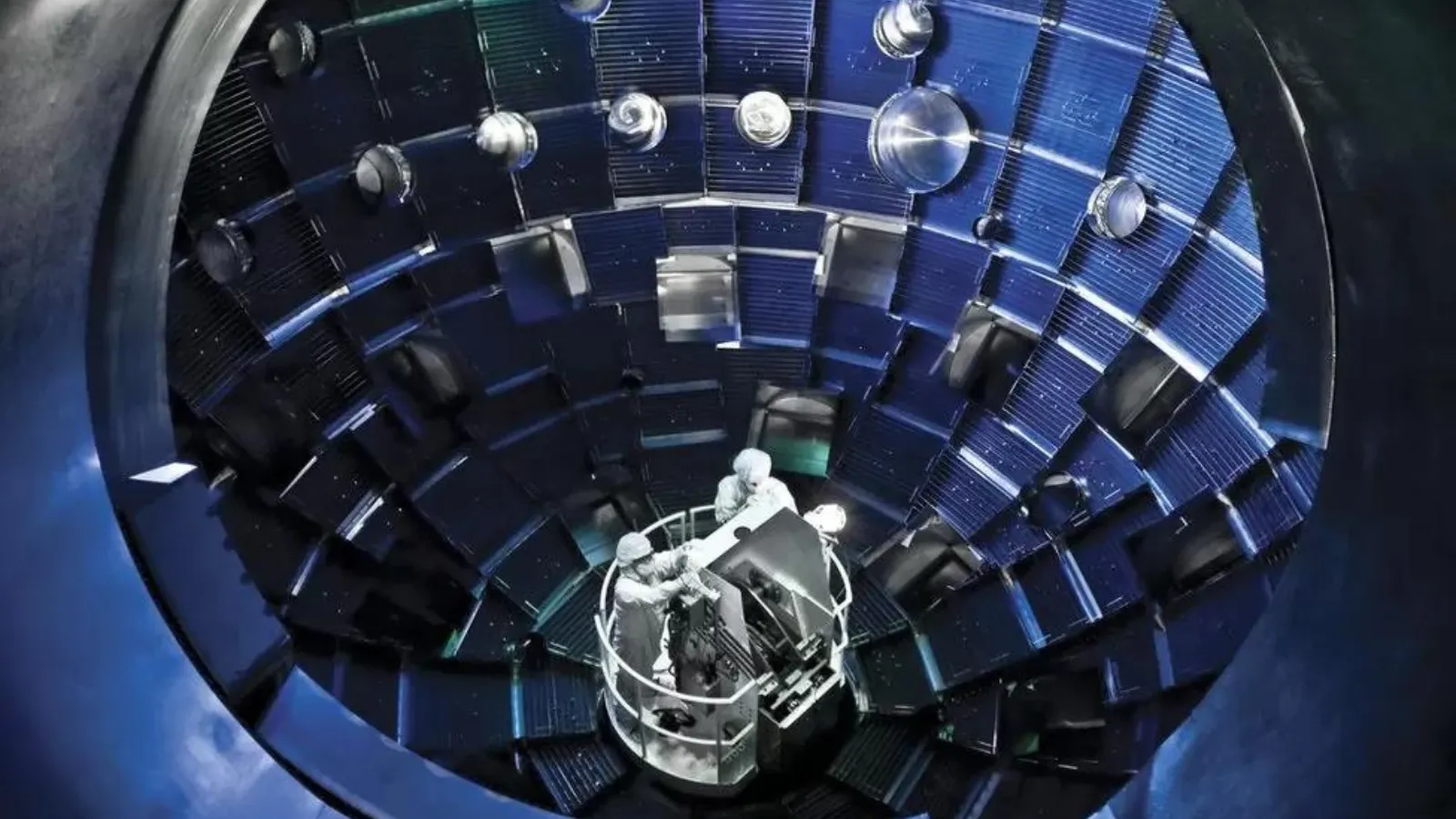

There are a variety of fusion concepts currently being investigated. The two concepts with the longest research time and therefore the greatest knowledge base are the “tokamak” magnetic confinement device, and inertial confinement “laser fusion”—like the National Ignition Facility (NIF) that achieved the important milestone of first energy gain in December 2022.

Then there are a number of other devices and configurations being pursued by mostly private fusion companies, such as the shear flow stabilised Z-pinch of Zap Energy to First Light Fusion’s projectile-driven inertial fusion, or the Novatron method of magnetic confinement in a completely different configuration to tokamaks.

We still don’t know yet which of these concepts will work or which will be able to be successfully commercialised.

Ian Chapman says: “The best solution won't necessarily be the first. It'll be the one that produces the lowest cost to the consumer. And if the consumer can get fusion energy at the lowest price, that will be the one that ends up with the biggest market share.”

2. There are 3 challenges facing fusion—technical, policy and commercial

The technical challenges are all formidable in their own right. Then not only do you have to do them all, you have to do them all at once. So the technical challenges are pretty severe. But they are not the only challenges.

Then there are policy challenges—how fusion will be regulated, how it enters into the market, or what sort of subsidies it might need.

And then there are commercial challenges. For example, how will fusion be funded in order to build the prototypes, which will be very capital intensive. Initial costs to build any fusion power plant will be in the billions.

Ian says: “So somehow you have to raise the billions, and you're doing so at quite considerable risk. And then, how do you make it commercially viable so that it can enter the market at the right price point, and how can you build plants sufficiently quickly with a high yield rate and high growth rate into the market—so that you actually penetrate to make a difference on the scale of the world.”

Of course, the challenges are also an opportunity for new developments, and UKAEA has a Technology Transfer team working to spin out interesting technologies developed by the fusion lab that could have useful, near-term applications in other sectors. As well as bringing economic benefit sooner, these technologies could also be developed further in these other sectors and later come to benefit fusion too.

Ian says: “Many venture capitalists do invest in fusion because they're taking a small bet on a long-term thing, but offsetting it with some near-term gain.”

The interior of the target chamber at LLNL, where nuclear fusion takes place © Philip Saltonstall

3. The major advances in fusion will not be technical but more commercial in nature

Ian Chapman: “The big advances, I think, are not necessarily technical advances, they're going to be advances which help us to drive down the cost and increase the maintainability—drive down the operating costs, actually make it more commercially viable. And I genuinely think that we will see big transformation in our field as we get more private sector and industry partners engaged with us.”