Unleashing American (Fusion) Energy?

By Samuel Ward, Fusion Advisory Services (FAS)

Fusion Advisory Services Ltd., a partner company to Fusion Energy Insights, provides deep technical dives on topics in nuclear fusion to investors and other decision makers.

Fusion may not have made it into the White House’s first ‘50 wins in 50 days’, but Donald Trump’s orders to “Unleash American energy” and “Declare A National Energy Emergency“ have loudly set a stage for the expected shift in US energy strategy. So, what role could fusion play?

Fusion in the USA

The United States has a strong heritage of fusion research. Princeton’s Tokamak Fusion Test Reactor (TFTR) in the 1980s was one of the earliest and largest experiments using tritium, alongside JET in the UK. And just over 20 years since the US had rejoined ITER, a burgeoning private sector is hitting its stride, at times attracting more investment than federal funding.

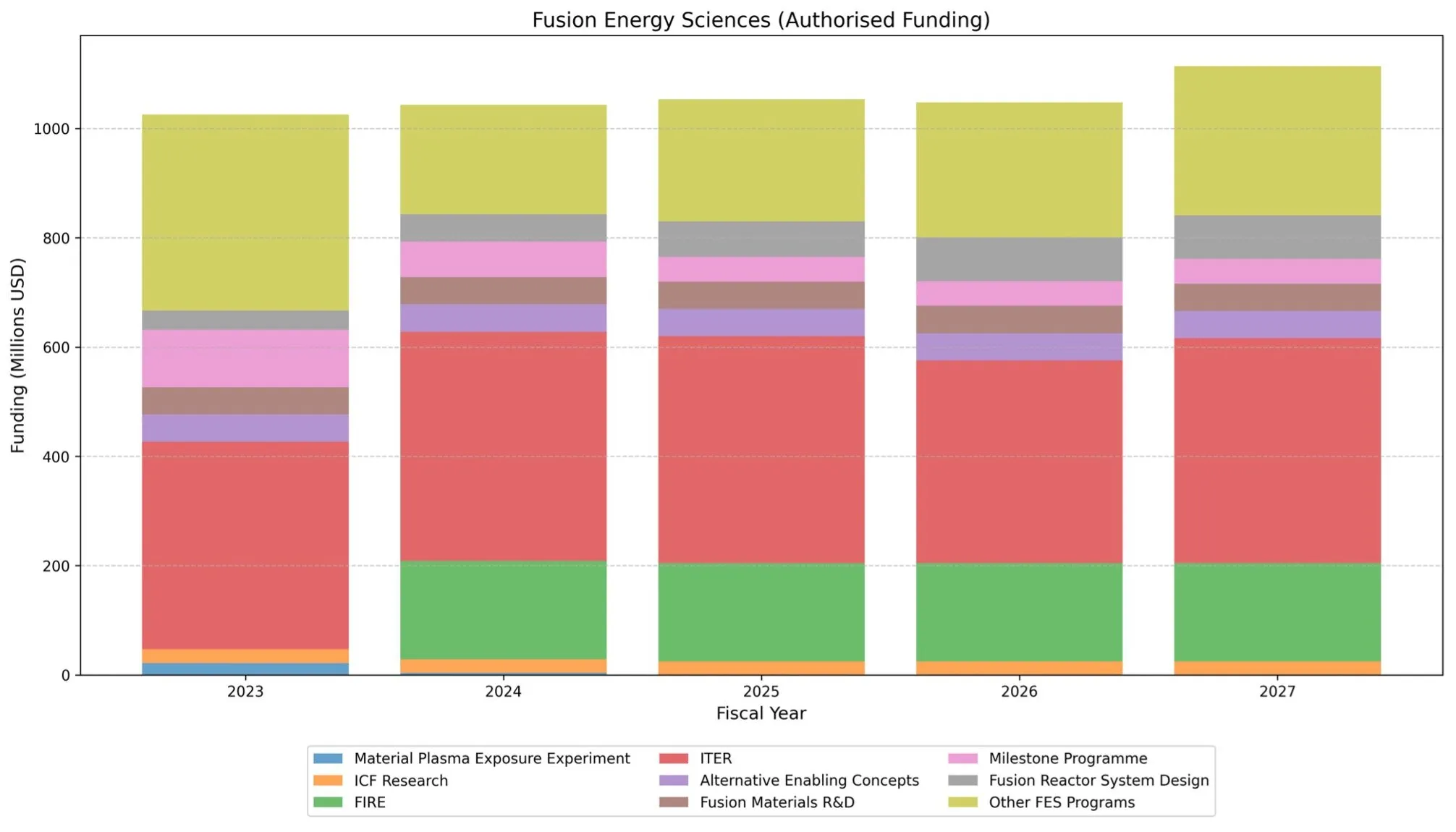

Coordinated under the Fusion Energy Sciences (FES) program within the Department of Energy (DOE), that funding will hover around a steady $1 billion per year until 2027, as laid out in the CHIPs and Sciences Act. In reality, less money leaves the coffers; in 2023, only 74% of the authorised federal budget for FES was appropriated for spending. $750M is still a hefty sum, but it needs to cover the entire domestic fusion ecosystem, from national experiments to private sector grants and awards. It’s also much less than the historical high of $1.3B (2021) enacted in 1977.

That all leaves room for manoeuvre, for near-term spending revisions in both directions, as well as justification for more significant expansion in the medium term via Congress. However, there are a few reasons to doubt why spending should fall.

Funding for fusion energy services in the USA over time. ©FAS

Would leadership decrease the federal budget?

For starters, senior figures in the Trump administration have been publicly supportive of technologies that complement oil and gas. That means traditional sources of firm power, whether they’re green or not: enhanced geothermal, nuclear fission, and nuclear fusion. ‘Baseload’ was a keyword during Interior Secretary Doug Bergum’s nomination hearing, whilst new DOE head Chris Wright stated he was committed to ensuring “that reliable and affordable baseload sources of power are protected.” Wright, who by extension now heads up FES, also specifically mentioned excitement for commercialising fusion within his lifetime. But what remains is how much of his direct attention will fall on fusion, as it has for the likes of fission and geothermal prior to his appointment. Before his role at the DOE, Wright was a board member for advanced nuclear firm Oklo, and under his leadership fracking firm Liberty Energy made investments in Fervo, a company pursuing advanced geothermal power.

Competition is another reason to be bullish. Energy dominance isn’t just for domestic markets but exporting American technology globally. That means a tightening of policy to end foreign commercialisation of technologies that start their life in American labs - including nuclear fusion. And if momentum continues building abroad, especially in China where budgets are swelling, that might focus US strategy on the near term. There are already pushes for this, with the Fusion Industry Association suggesting a one-time cash infusion of $5B. Similar suggestions are being made by the Special Competitive Studies Project, a non-profit chaired by Eric Schmidt. The initiative has now adopted a fusion strand in The Commission On The Scaling Of Fusion Energy, recently releasing a first report titled “Fusion Energy: Enabling 21st Century American Dominance”. As you might guess, it promotes fusion as not just technology but strategic priority, advocating three pillars:

- Declare Fusion a National Security Priority,

- Establish Fusion Leadership and Drive Commercialisation, and

- Strategic Investment to Win the Fusion Race.

Geopolitical context features in all three. Notably, the report recommends boosting cybersecurity of fusion firms, specifically citing China as the source of risk. Autumn will see this perspective expand, with the release of the commission’s report on ‘strategies to unleash American fusion energy leadership at home and abroad.’

Collateral damage

So with bipartisan support remaining strong, and sounding from both inside and outside the government, fusion’s near-term future appears relatively stable. But despite best efforts, the practical reality is that recent events have been anything but. Elon Musk’s aggressive cost-cutting actions whilst under the Department of Government Efficiency have slashed capabilities in some key areas. For example, one blunder saw a significant number of National Nuclear Security Administration (NNSA) employees fired and rehired. Besides the DOE and FES, the NNSA is the other significant source of fusion funding, fuelling nuclear security efforts like the National Ignition Facility, which recently set fusion research records by achieving scientific breakeven. But these incidents are not isolated, with the DOES also seeing cuts and subsequent re-hires, only after successful legal challenges.

Outside of DOGE, sweeping cuts risk spilling over to fusion. Early steps to repeal the Bipartisan Infrastructure Law and Inflation Reduction Act would impact ~$2.1T of authorised spending, including $280M for fusion set aside by the IRA. For example, it would scupper the aforementioned Special Competitive Project’s fusion commission, whose report advocates extending the IRA’s 45X advanced manufacturing tax credit to fusion equipment. As for the CHIPS and Sciences Act, the backbone of FES funding, Republicans are less keen, given the implications for national security and the potential impact on employment in republican states, which saw the bigger share of subsidies. Likewise, the DOE’s ARPA-E, one of the few funding sources outside FES and NNSA, has so far survived the calls for closure from Trump and authors of the influential conservative manifesto Project 2025. Instead, the agency was praised by Chris Wright at their recent annual innovation summit. For the most part then, fusion seems insulated.

Fitting in

So if fusion is here to stay, how might it practically fit in with the vision of American energy dominance? There’s no denying that most fusion concepts are large, complex devices, which employ new physics and technologies. Building a First Of A Kind (FOAK) device will be tough, particularly raising the necessary capital in the face of outstanding risks. That task was the domain of departments like the Loan Programmes Office (LPO). The LPO’s stated mission is to provide low-cost financing to clean energy and transportation projects that struggle to attract investment from traditional lenders who are wary of unique or FOAK investments….or to “get dollars out the door” as ex-director Jigar Shah puts it. Notable alumni of LPO-backed loans include Tesla, which, after receiving $500M, now manufactures roughly half of all US EVs. The LPO’s budget has historically fluctuated, vastly expanding under Biden, after being limited to nuclear projects under Trump’s previous term. There is a chance the LPO could retreat again, blocking an important future route to commercialisation; the office had only allocated roughly a quarter of its loan authority (roughly $100B), with nearly half of the commitments still conditional. But so far, disbursement has continued for projects aligned with the administration’s vision: $57M out of $1.52B for re-opening the Palisades nuclear plant, and a $1.67B guarantee for a sustainable aviation fuel refinery. With current efforts to shrink government, LPO may become crucial for gauging the federal government’s appetite for a central fusion strategy, which could struggle if left to private markets alone.

Outlook

As it stands, fusion’s future might hinge on its ability to avoid collateral damage from budget re-allocations. If fusion funding streams can untangle themselves from technologies targeted for cuts by Trump, then fusion’s credentials as a source of firm, baseload power, that America could lead the world in developing, might convince this government to keep doors open.

In parallel, the private sector will persist regardless. Fusion firms see relatively little of the federal budget, and the deeper scientific challenges, previously left to large-scale efforts like ITER, are now being tackled by smaller scale private experiments, for example tritium breeding and materials testing and characterisation. Targeted cuts to other technologies, for example offshore wind via early executive action, may create a glut of skilled workers. Instead, risks to American fusion firms will come in the form of giant tariffs, legal disruption caused by interruptions to federal grant contracts, and rapid swings in economic policy, which could inflate costs for fusion experiments and impact cost of capital - especially important with high CAPEX operations underwritten increasingly by value investors. Real reductions in DEI could also have a material impact on workforce availability and performance too.

So, for fusion too, uncertainty is a certainty. With the higher risk of macroscopic shocks, capital will need to be more patient than ever, and fusion firms might increasingly look toward early revenue stopgaps by commercialising spin-out technologies. What matters over the medium term is whether fusion can remain aligned with the “drill baby, drill” vision. If it can, there is no reason it cannot flourish relative to other next-generation power technologies.