How Enabling Technologies Are Carving Niches for Private Fusion Energy Companies

By Naomi Mburu, Fusion Advisory Services

Fusion Advisory Services Ltd., a partner company to Fusion Energy Insights, provides deep technical dives on topics in nuclear fusion to investors and other decision makers.

Over 55 companies worldwide are racing to deliver commercial fusion power. Many now focus on specific ‘enabling technologies’ that form the backbone of their fusion machine designs. In inertial fusion energy (IFE), the enabling technologies of precise fuel targets and next-generation drivers are vital. In magnetic fusion energy (MFE), ultra-strong magnets—often exceeding 20 Tesla—enable more compact devices. Regardless of the fusion concept, there are many enabling technologies which need innovation to help the fusion industry ahead of commercialisation, such as resilient materials and accurate diagnostic systems.

Fusion energy companies face a strategic quandary: building every component in-house can be time-consuming and expensive; yet off-the-shelf alternatives often do not meet the unique requirements of fusion. Compounding the problem is the lack of a robust supply chain dedicated to fusion-ready components, leaving fusion developers to balance the risk of becoming a “jack of all trades and master of none and therefore having to produce all their own fusion components, which means their focus is distributed. This reality drives fusion companies to strategically specialise in specific enabling technologies and, increasingly, to collaborate across the ecosystem to meet their technological needs.

Specialisation in Action

High-temperature superconducting (HTS) magnets are a prime example of a common technological specialisation. HTS must often be custom-built for each fusion concept. The private fusion company Commonwealth Fusion Systems (CFS) has placed HTS magnet development at the core of their machine design strategy and has actively shared their advancements in magnet technology with the fusion community. In the summer of 2024, Realta Fusion successfully used HTS magnets developed by CFS on their own machine—an example of how shared technology helps companies save time and money. This allows Realta Fusion to focus their efforts on other technologies such as their patented ion and electron radio-frequency heating system. Elsewhere, Helical Fusion, Renaissance Fusion, Thea Energy, Tokamak Energy and Stellarex are all exploring next-level magnet designs for tokamaks and stellarators alike. Looking ahead, UK Industrial Fusion Solutions is investigating remountable magnet joints to streamline maintenance for future power plants.

Another key area of specialisation is advanced computing tools. General Atomics created an open-source tool called FUSE, drawn from its own machine-design challenges. This technology benefits General Atomics directly, while showing potential to assist other magnetic fusion energy ventures to explore different fusion device configurations efficiently.

In inertial fusion energy, many companies, such as Blue Laser Fusion, Focused Energy, Innoven Energy, Marvel Fusion and Xcimer Energy, focus on the development of driver technologies such as high powered lasers capable of achieving high repetition rates. However, First Light Fusion stands out as a company that is driver-agnostic. Instead, they focus their efforts on the design and fabrication of their target designs which could potentially be used by a variety of inertial fusion energy drivers. As for Magneto-Inertial Fusion (MIF), Pacific Fusion and FUSE are honing in on impedance-matched marx generator technology to support their magLIF device concepts.

Building the Fusion Enabling Technology Landscape

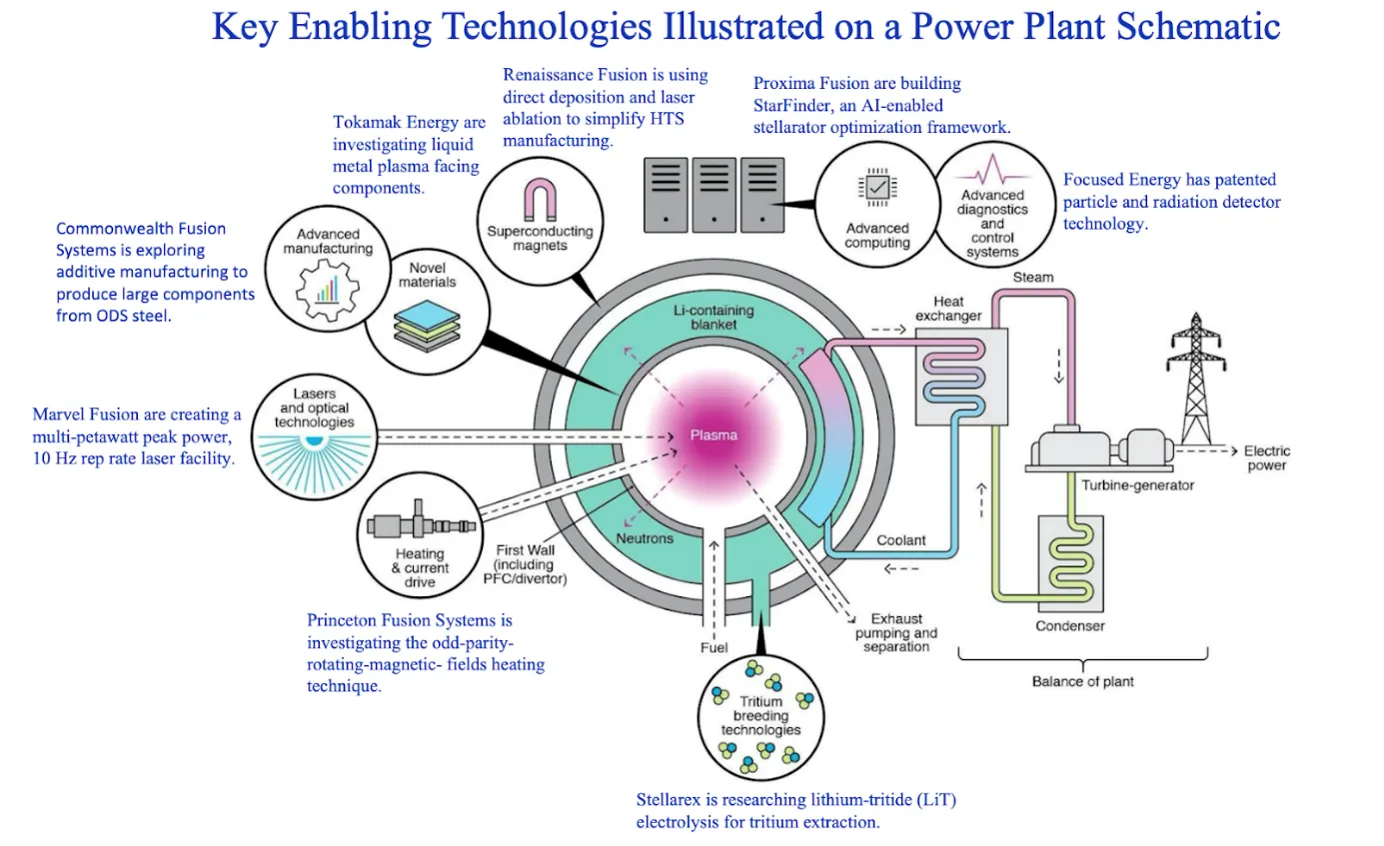

Many fusion energy companies are carving out distinct niches, contributing to a diverse and interconnected ecosystem of enabling technologies. The figure below highlights additional areas of focus, complementing the examples discussed in the previous section.

This Figure highlights just a fraction of the specialised efforts by fusion energy companies to drive the field forward. Each area represents a piece of the broader puzzle, emphasising how the collective efforts of the private fusion industry can come together to tackle the overarching challenge of fusion commercialisation.

Summary of key enabling technologies illustrated on a power plant schematic, highlighting in blue some relevant contributions from fusion companies. ©Chris Philpot

The Missing Link: Building a Specialised Supply Chain for Fusion

Beyond fusion startups themselves, there is a pressing need for supply-chain players who focus on fusion-relevant technologies. Observers suggest that the fusion sector could accelerate innovation by adopting a model similar to the aerospace industry, where major companies, such as Boeing and Airbus, function as integrators, assembling complex aircraft from components supplied by a vast, specialised global supply chain. Specialised fusion-relevant supply chain companies could focus on optimising components such as diagnostic equipment, vacuum systems and high-performance materials, allowing fusion machine developers to concentrate on integration and system-level challenges.

Kyoto Fusioneering was one of the first fusion-specific supply chain companies to emerge, dedicating its efforts to technologies like heat exhaust systems and tritium handling, which are essential for supporting a wide range of fusion machine designs.

As enabling technologies evolve, a breakthrough in one area can force redesigns elsewhere. Stronger magnets, for instance, may require upgraded diagnostics that can withstand higher field strengths. A specialised, scalable supply chain could adapt quickly, iterating each component to meet fast-changing demands. This division of labour not only speeds up the design iteration cycle, but enhances scalability and helps drive the development of standardised, high-quality components crucial for commercial fusion power.

From Fusion Spin-Out to Fusion Spin-In: The Broader Impact of Fusion Innovations

Fusion’s technological advances often extend well beyond energy production. A clear example of spinning out technology from fusion is TE Magnetics, which grew out of Tokamak Energy. By capitalising on breakthroughs in high-temperature superconducting magnet technology originally developed for fusion, TE Magnetics aims to improve magnet-based solutions across multiple industries, from magnetic levitation for transportation to advanced physics research

Conversely, SHINE Technologies showcases a ‘fusion spin-in’, drawing on the company’s broader nuclear expertise to develop fusion energy capabilities. Alongside its future fusion power plant plans, SHINE develops and commercialises nuclear technologies for component testing and medical isotope production. This interplay of ideas, where expertise flows both out of and into fusion, highlights how the industry’s progress can spur broader technological advances.

The Road Ahead

Progress towards commercial fusion hinges on more than bold fusion power plant designs. It also demands enabling technologies that keep pace with rapid innovation. By zeroing in on niche specialties and sharing breakthroughs, private fusion players are constructing a robust ecosystem to meet the field’s unique demands.

As global efforts in commercial fusion gain momentum, companies are not only redefining energy production but also unlocking transformative technologies that could influence adjacent industries as well. Ultimately, the success of fusion companies will be measured not only by their ability to deliver energy to the grid, but by the trail of groundbreaking innovations they leave in their wake.