FusionXInvest Boston - bringing together capital and opportunity in the fusion industry

Fusion Energy Insights founder Melanie Windridge was in Boston, USA, last week for FusionXInvest, a conference bringing together capital and opportunity in the fusion industry. Melanie is a co-founder of FusionXInvest with her partners Stuart Allen and Matthew Perks.

Other events were organised around FusionXInvest, making the week a busy fusion get-together.

Here’s her summary of the week.

Melanie moderating a panel at the Commercialization Pathways for Fusion Energy workshop hosted by Harvard Business School and MIT Sloan School

Well, what a blast it was in Boston! FusionXInvest was a great success and, as ever, I enjoyed catching up with colleagues in the fusion industry, meeting Fusion Energy Insights members and getting to know new people with a common interest in fusion. There was a lot going on….

On Tuesday there was a workshop on Commercialization Pathways for Fusion Energy hosted by Harvard Business School and MIT Sloan School. I moderated an afternoon panel on Pathways to the Grid - Building a Company.

One little nugget I loved from that panel was Heather Jackson (ARPA-E Tech-to-Market Advisor) comparing selling energy with selling children’s vitamins. That is, you need to build something that the users want and the payers will pay for.

Heather said: “The fission industry messed this up. They sold children’s vitamins to the adults, and the kids spit them out into the trash. For fusion energy to succeed, we need to build energy devices that are wanted by both sets of stakeholders. This requires engaging with both sets of stakeholders.”

Key figures in the fusion industry at the Commercialization Pathways for Fusion Energy workshop at Harvard Business School.

Other stand-out sessions were the opening and closing pieces by Phil Larochelle (Breakthrough Energy Ventures) and Dennis Whyte (MIT)—both super smart and great at showing the numbers and evidence with compelling humour.

In the evening the UK Science & Innovation Network (under the British Consulate in Boston) held a reception celebrating the long-standing UK/US partnership for fusion energy.

Then, on Wednesday, it was the big day for FusionXInvest.

The weather was crisp and clear. We organisers saw the sunrise from the full windows of the Samberg Centre’s 7th floor, coming up behind the city skyscrapers and flooding the room with natural light. It was a fabulous backdrop the entire day.

The day began with an opening from Susan L. Moran, State Senator for Massachusetts, and welcoming remarks from Dennis Whyte from the MIT Plasma Science & Fusion Center (PSFC), with whom plans for this event partnership were first hatched.

I then started the discussions with the Keynote Interview, where we heard from Phil Larochelle (Breakthrough Energy Ventures) and Clea Kolster (Lowercarbon Capital) about the opportunity of fusion, why interest is growing, what’s needed for fusion funding, and about their investments in fusion.

A packed room of delegates at FusionXInvest

The day passed in a whirl, with all of the panels being engaging and thought-provoking. Here are a handful of observations made by Jamie Dunsmore, an MIT fusion research PhD student:

- The narrow focus on energy breakeven hasn’t always been helpful for fusion, disguising the huge scientific progress that has been made over the past decades while also taking attention away from other challenges that must be tackled before commercial operation.

- There was general consensus among the panellists that, although many scientific and engineering challenges remain, the biggest hurdle for fusion companies right now is raising the money to tackle those challenges.

- Investors won’t necessarily need to see a fusion company all the way to commercial success in order to make money. Andrew Lo drew comparisons with the biotech industry, where investors who identify promising start-ups can provide capital at an early stage, see the technology to greater maturity and then make money through an IPO or an acquisition from a large pharmaceutical company before the new product even hits the market. The panellists discussed whether a similar model might work in fusion.

FusionXInvest delegates at the site visit to Commonwealth Fusion Systems.

Then, on Thursday, we went on visits to Commonwealth Fusion Systems, the largest private fusion company and a spin-out from MIT, and the PSFC.

It was wonderful to see the progress CFS is making on construction of their Devens facility, where the SPARC tokamak will be located. The large tokamak HTS magnets were being wound in their specialist magnet facility. The offices are smart and slick, and their restaurant is called the “Lawson Cafeteria”—a fusion geek joke that tickled me. They had a big picture of that graph (progress towards the Lawson criteria) on the wall.

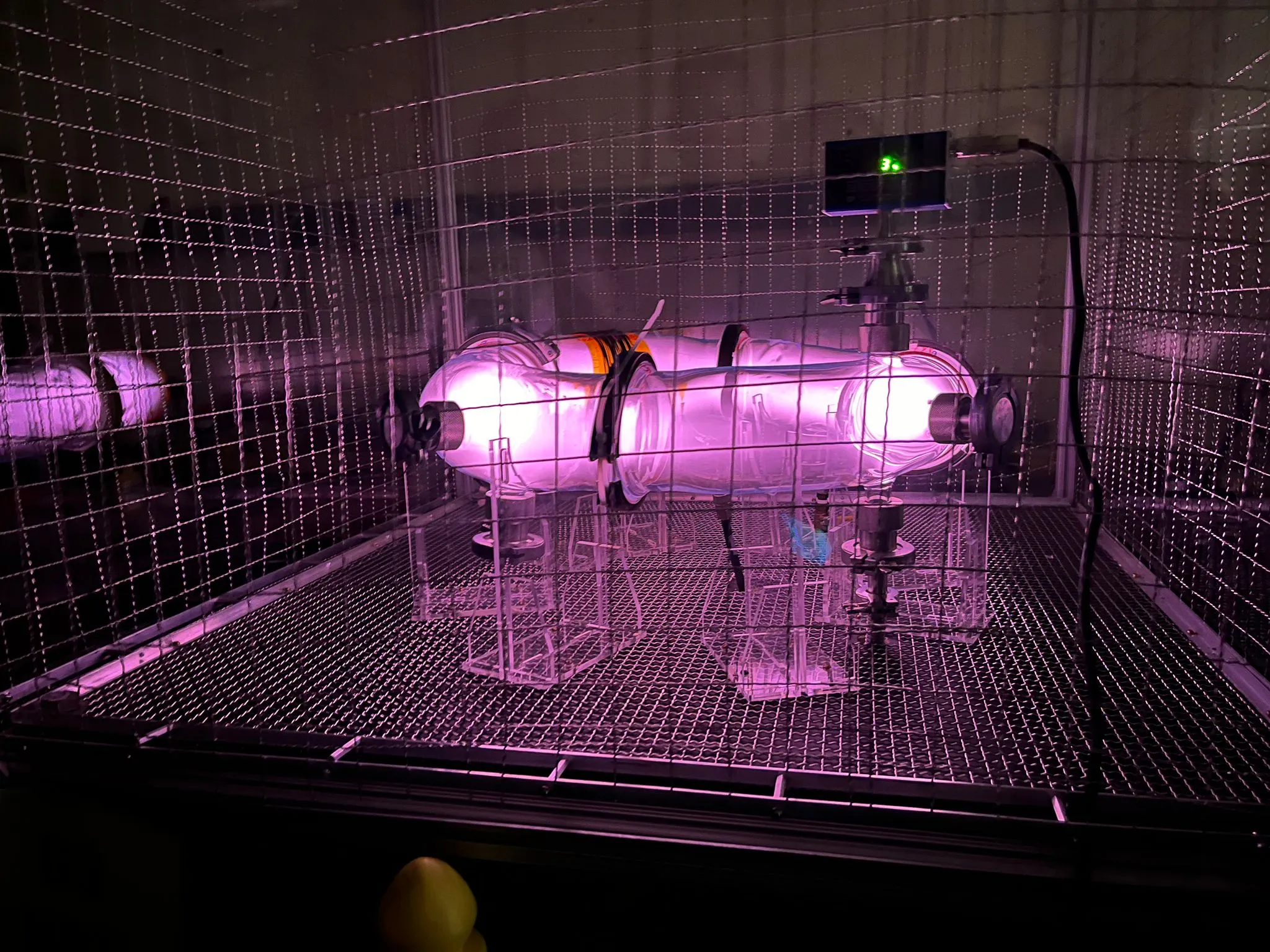

Then at PSFC we saw plasmas, magnet testing labs and the remnants of Alcator C-mod, a previous research tokamak that launched the careers of the CFS founders.

Plasma in a small demonstration torus at the PSFC, MIT.

The visit day was a fun and informal way to get to know new people and start potentially important discussions on the bus or over a beer. It was a great way to wrap up a busy conference.

We, the FusionXInvest team, were delighted with FusionXInvest Boston. The vibe and the energy in the room was beyond what I ever anticipated.

We are grateful to MIT’s PSFC for co-hosting and to all the speakers and attendees for their participation.

The growing optimism and momentum in the fusion sector is now clear to see. Through Fusion Energy Insights (and our Fusion Advisory Services) and FusionXInvest I want to do all I can to help people understand more about fusion, see opportunities and take action wherever they fit.

At FusionXInvest we had plenty of conversations about how to intensify FusionX's support of the industry and are already planning future meetings. Make sure you’re subscribed to stay in the loop.