A Year in Fusion: 2024

By Naomi Scott-Mearns and Lizzie Mushangwe

A long-form version of this article appears in the December Quarterly issue available to members of Fusion Energy Insights. Sign up to become a member today.

2024 has seen the fusion energy industry further maturing, with new strategic partnerships announced on the international level and companies level, the first meeting of the IAEA’s World Fusion Energy Group, new science/technology announcements and a run of good funding news towards the end of the year. Take a look at the News Insights section of our blog articles to see some of the stories we’ve covered this year.

As the year ends, we run down what the team at Fusion Energy Insights see as the 3 biggest fusion trends of the year.

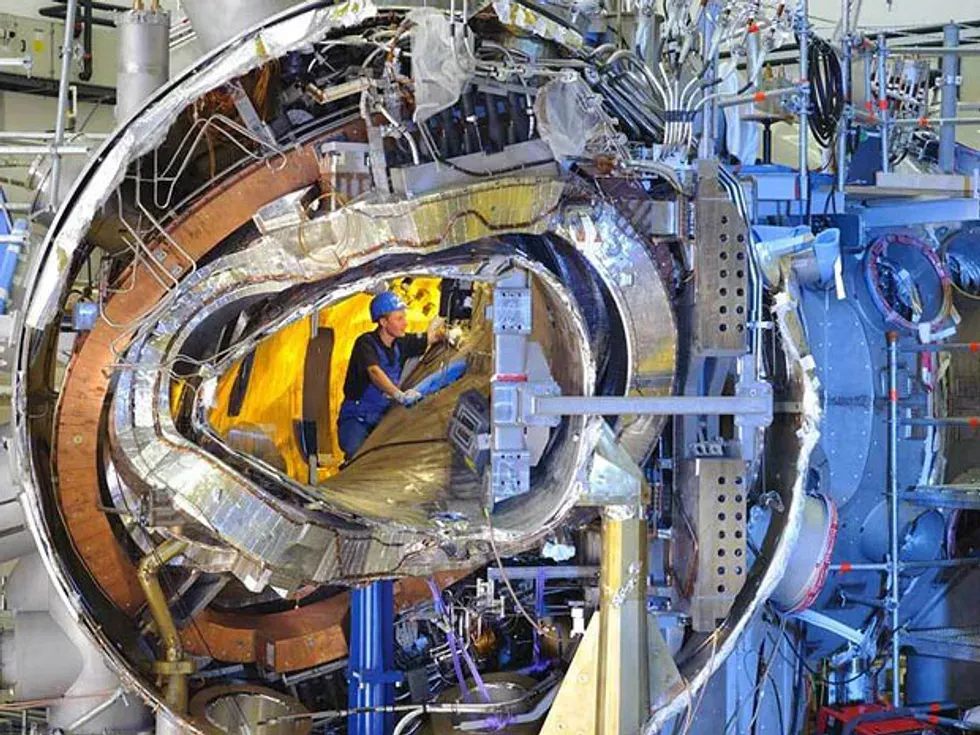

The interior of the Wendelstein 7-X stellarator fusion experiment in 2011 ©Wolfgang Filser/IPP

1. Artificial Intelligence (AI) and fusion

Artificial Intelligence is creeping into our lives everywhere. The relationship between AI and fusion goes both ways. AI is helping fusion solve problems, but fusion energy is also a potential solution for energy-hungry AI.

Firstly, AI is proving to be enormously powerful in helping to solve the remaining challenges to fusion technology. AI can build models and work through problems more efficiently and faster than previously. There are many examples of AI being implemented to solve fusion problems.

The Clean Air Task Force released a report at COP29 in Baku that explores the transformative role of high-performance computing (HPC) and AI tools in advancing fusion energy commercialisation. Fusion Advisory Services, a partner company to Fusion Energy Insights, contributed to the report alongside EPRI, the Electric Power Research Institute. The report argues that the use of AI and high performance computing will fast-track fusion commercialisation.

Secondly, the businesses that are not embracing AI fear that they will be left behind. Whilst AI can be enormously helpful, this help comes with a cost: an energy and carbon cost. AI is a huge energy consumer. On average, a ChatGPT question needs nearly 10 times more electricity to process as a standard Google search.

Due to the enormous energy consumption of AI, leading technology companies have been looking at alternative energy sources to help power their data centres and this has led to many technology companies looking at fusion energy.

2. Fusion Spin-Offs & Earlier Revenue Streams

In 2024 we’ve begun seeing more fusion companies exploring complementary strategies and new revenue streams by directly commercialising core technologies to address immediate market needs. This is understandable given the long timescales of fusion research and development towards commercialisation in comparison with investor horizons, coupled with the need to raise hundreds of millions of dollars to build fusion demonstrator devices to hit energy breakeven.

Fusion companies that have begun exploiting their technologies include:

- Tokamak Energy launched TE Magnetics in the summer of 2024 to produce high-temperature superconducting (HTS) magnets.

- SHINE Technologies has adapted fusion methods to produce molybdenum-99, a key isotope for medical imaging, through their fusion-based medical isotope production system.

- And more

The creation of spin-off companies and alternative revenue streams ultimately attracts investment, which leads to job creation and stimulates economic growth while bridging the gap between research and real-world impact of a technology.

3. The Stellarator Approach

The rise in popularity of the stellarator in recent years is driven in part by key successes at the Wendelstein 7-X stellarator in Germany, and in part by increasing capabilities in high performance computing and manufacturing that make the increased complexity of the stellarator (compared to a tokamak) more tractable.

Stellarators are similar to tokamaks in that they confine plasma using magnetic fields in a toroidal (ring-doughnut-shaped) configuration. However, whereas tokamaks have a component of the confining magnetic field generated by a current flowing in the plasma, stellarators create the twisty, helical magnetic field by the shape of their magnets, which are therefore twisty and complex.

An advantage of stellarators is inherent plasma stability and the ability to operate steady-state, which is desirable for future electrical grid connections and makes them a strong contender for commercial roll-out. Plus, their similarity to tokamaks means that key fusion components, such as breeder blankets and divertors, are very similar for both devices and therefore there are opportunities for technology transfer.

According to the Fusion Industry Association’s report The Global Fusion Industry in 2024, stellarators are now the most common fusion technology amongst private fusion companies. There are eight companies globally pursuing stellarators, compared to seven laser-driven inertial confinement projects and six tokamak projects.

Stay with us in 2025 to follow the evolving fusion industry.