2025 Progress in the Fusion Industry

What were 2025’s biggest developments in progress towards nuclear fusion for energy?

2025 marked a major acceleration in our progress towards realising fusion energy, with both governments and private industry signalling unprecedented confidence in the field’s technological and commercial momentum.

Leading governments have recognised the progress that fusion is making and are stating their commitments to remain at the forefront of technology development. This is especially true of the United States in the face of rapid Chinese progress in both construction and investment. Many national strategies have shifted meaningfully with:

- Japan formally designating fusion as a key national strategic technology

- Germany committing over $2 billion to its domestic fusion programmes

- The United States advancing its leadership through new federal roadmaps, investment in fusion tech development, and the creation of a dedicated Office for Fusion.

Funding for fusion companies also surged to an all-time high of $4.4 billion invested in one year, exceeding the combined totals of 2022, 2023 and 2024, with the top three companies alone now capturing over 50% of total investment into all fusion companies.

The year also saw 15 new fusion companies emerge globally, including India’s first three companies, and China’s announcement of the China Fusion Energy Company, backed by more than $2 billion.

Fusion also attracted three new customers through newly established power offtake agreements. These new customers were Google, Eni, and Aoki Super, each from a different sector (big tech, oil and gas, and grocery), and notably all also investors in the respective fusion companies.

Three new national fusion entities were also established:

- Canada’s Centre for Fusion Energy

- Germany’s SaxFusion initiative

- The Initiative for Fusion Energy in California

Together, these developments are setting the stage for a transformative decade ahead, with fusion starting to take a prominent role in the future energy security plans of major nations, especially with the ever increasing power demand from AI data centers.

An Overview of Private Investment

How much has been invested into nuclear fusion companies?

Which fusion companies have the most investment?

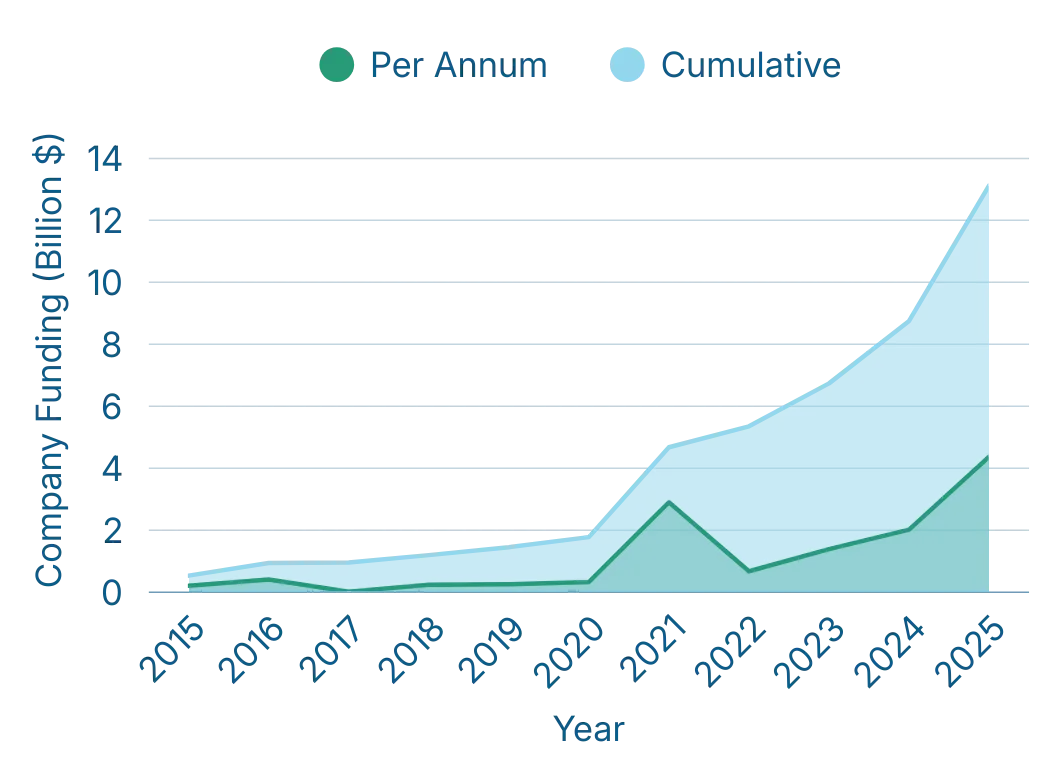

A plot showing the yearly and cumulative investment into private fusion companies over the past decade. ©Fusion Advisory Services

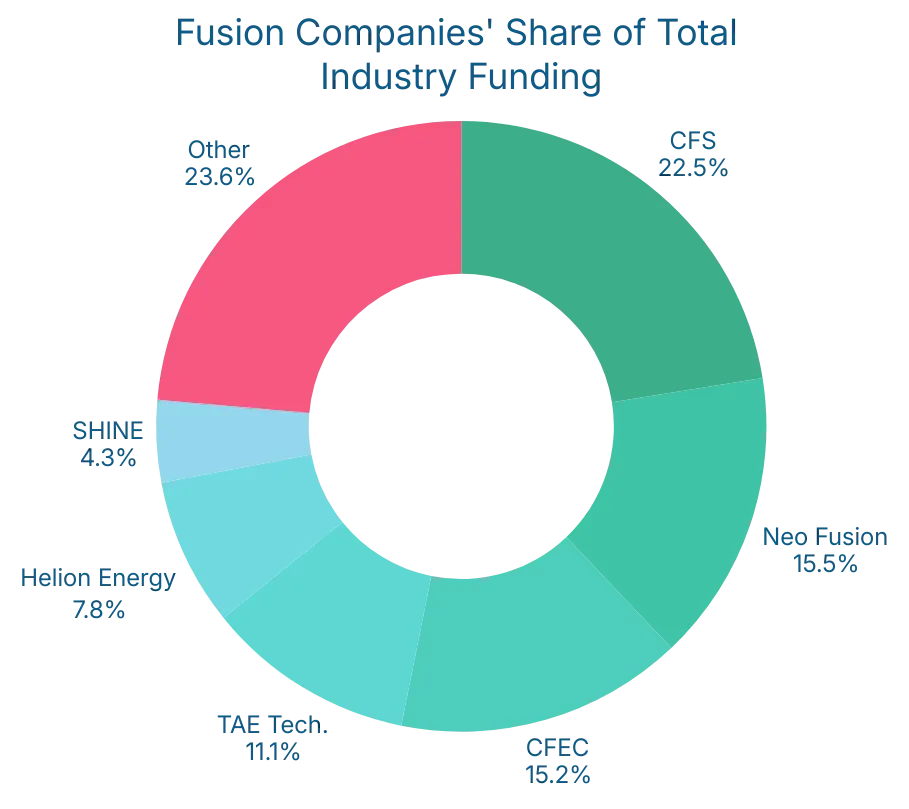

A pie chart displaying how the $14bn total funding is distributed between top fusion companies. ©Fusion Advisory Services

Top companies are consolidating their positions as leaders for their respective design concepts, with the top 3 now making up over 50% of total investment into all fusion companies, and the top 6 accounting for 75%.

Note, a ‘fusion company’ refers to both privately held and government-owned companies, whose funding is separate from any state backing for national laboratory-run projects. This year, there was an additional $4.4bn raised over around 20 funding announcements, the highest ever, and more than 2022, 2023 and 2024 combined. Overall, this brings total fusion company funding over $13bn.

As displayed in the funding pie chart, the top 6 fusion companies by total raised funds are: Commonwealth Fusion Systems (CFS), Neo Fusion, China Fusion Energy Company (CFEC), TAE Technologies, Helion Energy, and SHINE. Given not all funding is announced (via articles), or even declared, whilst figures may not be accurate to the ‘million’ (for larger companies), they are indicative of total funds received.

Some companies may have ‘raised’ funds to be released over time, but these are not included in funding figures. It is also worth noting that, although many companies receive public funding, both CFEC and Neo Fusion are backed purely by central and provincial government bodies, and as such are tough to objectively compare to privately held fusion companies.

Fusion Company Funding by Country

Which countries are leading in private fusion energy investment?

Which fusion companies received the most investment in 2025?

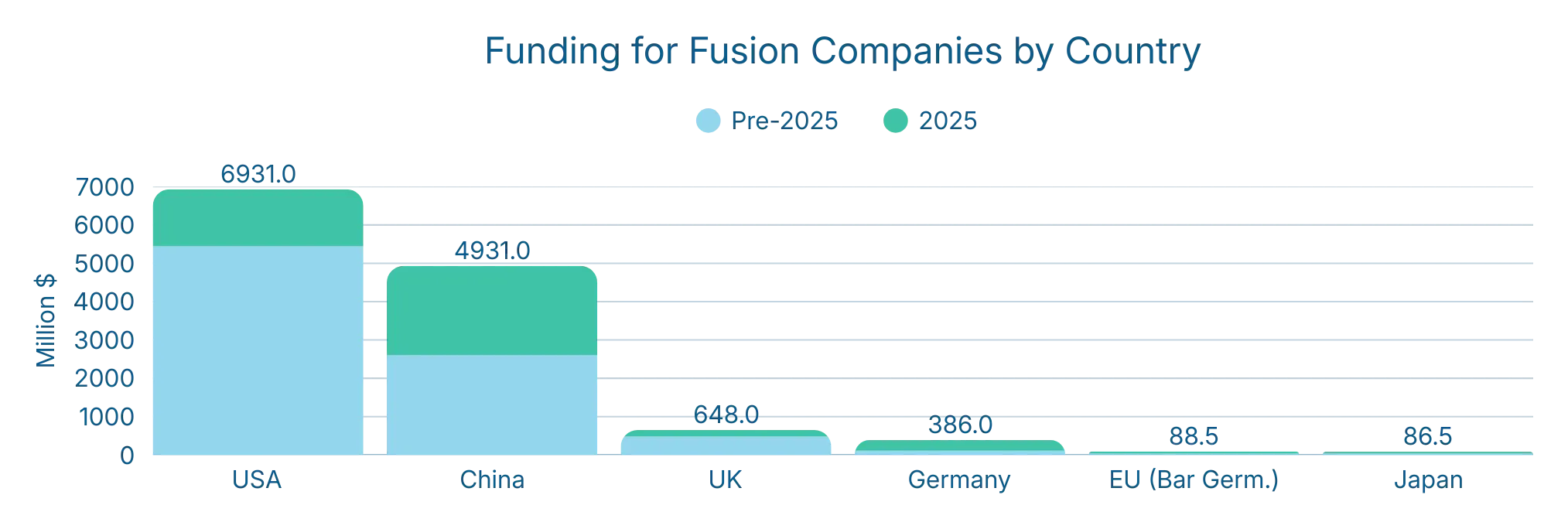

Funding distribution between countries, with the USA in the lead but China gaining ground for 2025. ©Fusion Advisory Services

Whilst the USA is still markedly in the lead for total investment into its fusion companies, in 2025 its annual amount was overtaken by China (as highlighted by the first chart), which has been rapidly scaling its investment into the sector. Whilst much of this is government funding, by directly pushing forward its fusion industry it has attracted many private investment firms to back a number of rapidly growing Chinese fusion companies, which are largely centred in Shanghai and Hefei.

Similar hubs have developed in San Francisco and Seattle in the US, but more organically, with the government only now starting to step up its involvement to meet competition. Whilst financially behind, the UK and Germany have still made serious progress in the private sector, with companies there sure to benefit from their respective governments funding into public programmes.

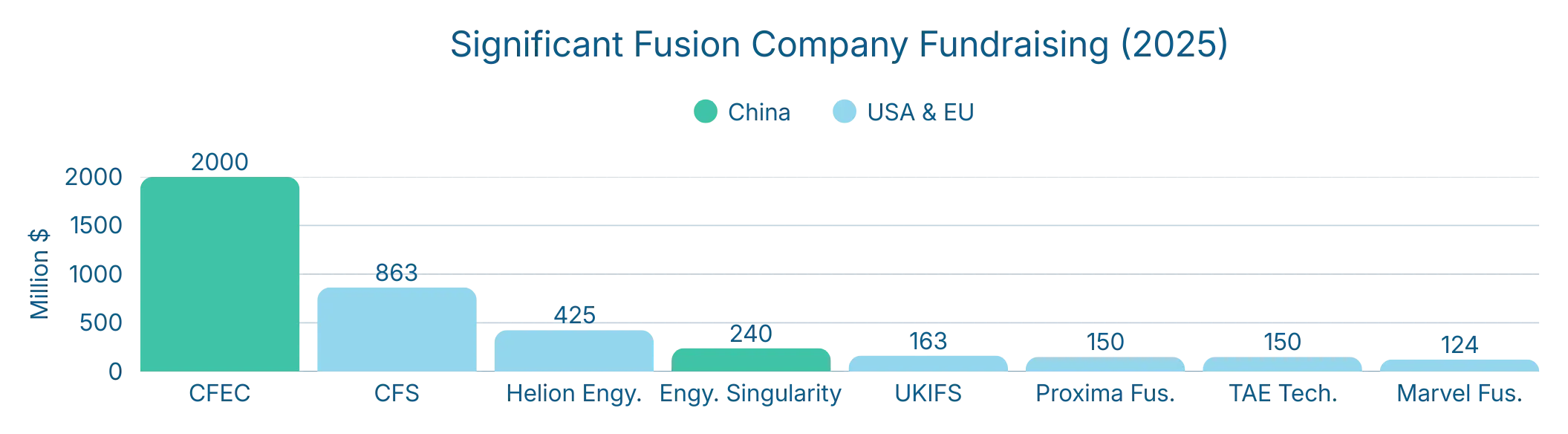

The largest fusion funding rounds of 2025. ©Fusion Advisory Services

The second chart highlights a highly concentrated year for fusion company funding in 2025, with a small number of very large rounds accounting for a substantial share of total capital. Whilst Chinese company CFEC dominated the top end with its ~$2 billion raise, funding rounds in the US and Europe were far more numerous, if markedly smaller. These were led by Commonwealth Fusion Systems at nearly $1 billion, followed by a steep drop-off to sub-$500 million rounds.

The distribution underscores a widening gap between a handful of capital-intensive, state-adjacent Chinese players (such as Neo Fusion or ENN), and Western firms that, while still attracting significant private investment, are progressing via comparatively incremental financing steps rather than mega-rounds.

Private Fusion Funding by Concept

Which nuclear fusion device concept is the most popular?

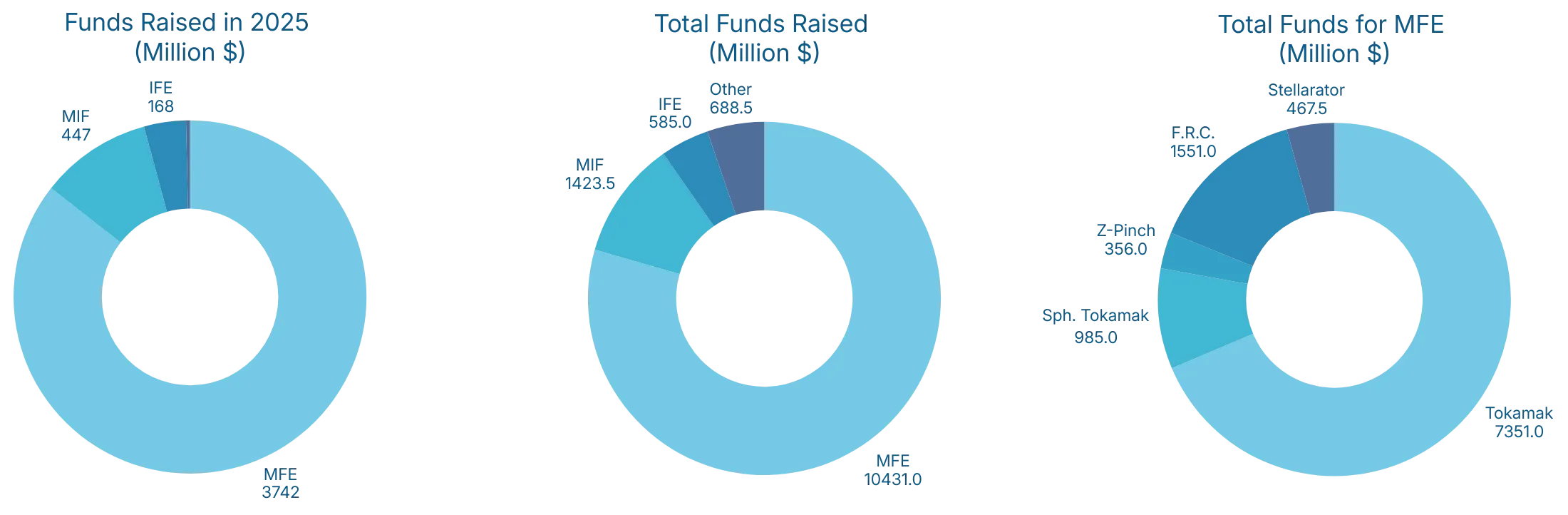

Funding in fusion research and development has always been unevenly distributed between the main device concept categories: magnetic confinement (MFE), magneto-inertial confinement (MIF), and inertial confinement (IFE). The tokamak (magnetic fusion) concept has now emerged as the favourite of national labs (e.g. JET, STEP), international projects (ITER), and private developments (SPARC). However, it is worth highlighting the wide diversity of the current fusion landscape.

The three pie charts clearly display the preference for the tokamak concept, which accounts for 56% of total fusion company funding. MFE is also the clear favourite of both the USA and China, who have each now invested roughly $5 billion into its development. However, whilst MFE is the focus of all Chinese companies, the US, UK and Europe show a wider range of device concepts in development, with the US and Canada being the exclusive developers of private MIF concepts.

Breakdown of private funding based on fusion device concept. ©Fusion Advisory Services

Industry Newcomers

How many private nuclear fusion companies are there?

Which fusion companies were founded in 2025?

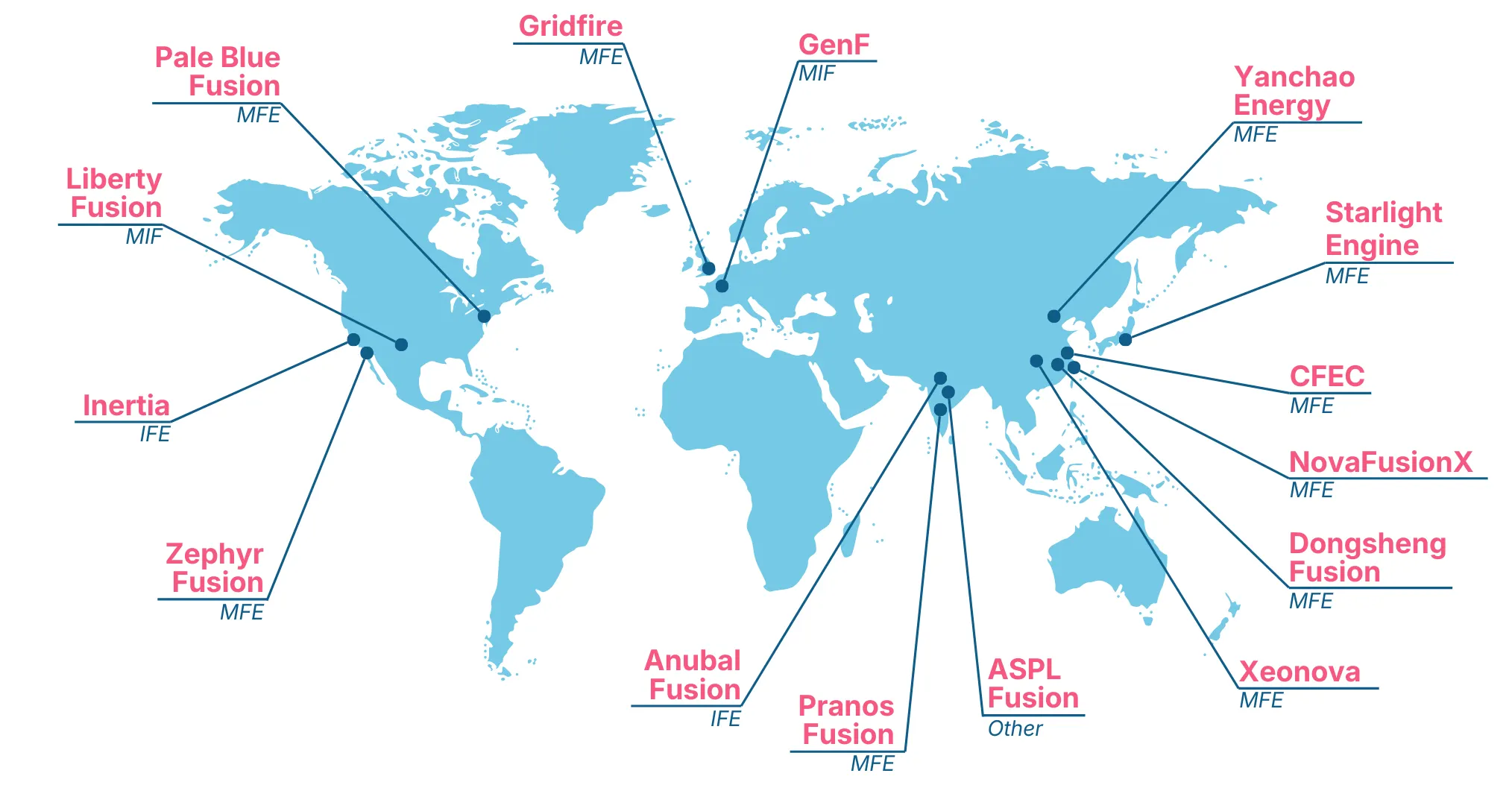

In total, over the past year there were 15 new fusion companies to either register, or make their presence public. Whilst most are pre-seed or currently small, the China Fusion Energy Company (CFEC) has received over $2bn from the Chinese government, making it now the third largest fusion company. Overall, China almost doubled its number of fusion companies, going from 6 to 11, all pursuing various MFE concepts.

Other points include NovaFusionX raising around $70m in private funding, Inertia attracting some top talent, and Zephyr Fusion seeking to build fusion devices in orbit (utilising zero-g conditions). This now brings the total number of fusion companies globally to around 80.

The map displays the locations (HQ) of the new fusion companies. ©Fusion Advisory Services

Top News by Region

What fusion developments happened around the world in 2025?

- United Kingdom: On top of its immediate £410m investment into fusion, the government has pledged a total of £2.5bn over coming years. It has also invested £20m into a fusion VC fund, Starmaker One. Fusion company First Light Fusion pivoted its projectile based inertial fusion concept to fast ignition, where a target is compressed and then heated to fusion conditions.

- United States: The 2026 budget highlighted energy leadership as a key issue, including in fusion. Following this, the DOE published a Fusion Science & Tech roadmap, invested $134m into fusion tech development, and created its own dedicated Office for Fusion. A Commission on the Scaling of Fusion Energy showed Chinese progress as a key incentive to increase government efforts. National labs are collaborating with the University of California to develop the ‘Initiative for Fusion Energy’ hub. Beyond the discussed US company funding rounds, there has also been a (200MW) power purchase agreement between CFS and Google, and a $1bn offtake agreement between CFS and Eni, similar to the earlier deal between Helion Energy and Microsoft.

- Germany: The country’s new government has shown its firm support by committing almost $3bn to its own fusion programmes, of which W7-X recently achieved the best ever results for a stellarator. Two companies, Proxima and Gauss Fusion, have unveiled full fusion power plant designs, in addition to Proxima Fusion receiving record funding (in Europe). A new competence network in Saxony, SaxFusion, aims to bring together industry and research.

- Canada: After securing further funding this year, General Fusion has kept its place as one of the 10 highest funded fusion companies. The government also continues its support, setting up the ‘Centre for Fusion Energy’ in Ontario, a public-private partnership.

- The EU: The European Commission began work on the EU’s first fusion strategy to support commercialisation across member states, with the EU also supplying €200m for IFMIF-DONES, a fusion materials testing facility in Spain. At ITER in France, the year was characterised by the acceleration of tokamak assembly, which reached some key milestones. This includes the installation of three vacuum vessel sector modules into the tokamak pit, out of a total of nine required. The fifth module of the central solenoid was also stacked, making it now near completion.

- Japan: In a major statement, the government designated fusion as a key national strategic technology, alongside AI and semiconductors. Recently, the new company Starlight Engine released a conceptual design report for its tokamak ‘FAST’, and Helical Fusion signed a power purchase agreement with supermarket Aoki Super.

- China: A recent SCSP report suggests that China has invested at least $6.5bn into fusion since the start of 2023, which aside from its own companies, involves a roster of accelerating government run projects. This includes the BEST tokamak (whose base was just completed), and the adjoining CRAFT fusion campus (now running tests). In addition, this year has seen construction progress on the NIF-style Mianyang Laser Facility, and the Xinghuo Fission-Fusion hybrid reactor. The current flagship tokamak EAST set a record for plasma pulse duration in January, which has since only been beaten by WEST (France).

- India: After being an ITER member for 20 years, and running government tokamak experiments for 36, India has now gained three fusion companies. Pranos Fusion is developing a spherical tokamak device, Anubal Fusion is pursuing laser-driven inertial fuel compression, and ASPL Fusion is prioritising commercial applications.

Looking Forward - Milestones for 2026

What will happen to nuclear fusion in 2026?

For the fusion industry, many major developments are scheduled to be taking place over the next year, with some devices predicting construction completion or even breakeven demonstration (scientific Q>1).

It is likely that the high levels of funding seen in 2025 will continue, with governments following through on finance promises, and technology progress driving further investment. This is especially true for China, whose plans will continue regardless of the private investment landscape.

So far, for 2026 we can expect:

- Commonwealth Fusion Systems (CFS) to complete construction of SPARC (MFE), and conduct initial tests (Q>1 in 2027).

- General Fusion to showcase LM26 (magneto-inertial fusion), potentially reaching breakeven.

- TAE Technologies announced in mid-December a $6bn+ merger with the Trump Media & Technology Group (50/50 split), closing mid-2026, providing $300m capital and plant construction.

- ENN (China) to complete construction of EHL-2 (magnetic confinement fusion).

- More completed devices at Novatron (magnetic fusion), Renaissance Fusion (magnetic fusion), and Xcimer (inertial fusion), with construction progress at Type One (magnetic fusion).

- Expected operation of the Divertor Tokamak Test Facility under Italy’s ENEA.

Further tokamak assembly at ITER, including three scheduled insertion events. These are the fourth, fifth, and sixth vacuum sector modules, the final central solenoid module, and work on the compression structure.